Helping employers keep up to speed with the East Sussex Pension Fund

We are pleased to provide our latest employer newsletter. This will help you keep up to date with the East Sussex Pension Fund. All articles can be viewed via this website page.

We are always looking for ways to develop and engage with our employers so please contact us with any ideas or further support you require. We would also like to remind employers to contact us at the earliest possible opportunity if they are dealing with things like redundancies, change of payroll providers, personnel changes and admissions/cessations from the Fund.

Email: [email protected]

Kind regards

East Sussex Pension Fund

Member contributions

From April 2024 employee contribution salary thresholds and rates are changing. See table below for salary bandings and employee contribution levels that will apply.

| Band | Actual Pensionable pay for an employment | Main Section contribution rate | 50/50 section contribution rate |

| 1 | Up to £17,600 | 5.50% | 2.75% |

| 2 | £17,601 to £27,600 | 5.80% | 2.90% |

| 3 | £27,601 to £44,900 | 6.50% | 3.25% |

| 4 | £44,901 to £56,800 | 6.80% | 3.40% |

| 5 | £56,801 to £79,700 | 8.50% | 4.25% |

| 6 | £79,701 to £112,900 | 9.90% | 4.95% |

| 7 | £112,901 to £133,100 | 10.50% | 5.25% |

| 8 | £133,101 to £199,700 | 11.40% | 5.70% |

| 9 | £199,701 or more | 12.50% | 6.25% |

The contribution rate depends on an employee's pensionable pay. It will be between 5.5% and 12.5% of this. The rate paid depends on which pay band they fall into.

If they work part-time or term time, their rate is based on the actual rate of pay for their job. So, they only pay contributions on the pay they actually earn.

These changes could mean the % contribution they pay could change if their pensionable pay at 1 April 2024 takes them into a different banding. Please ensure that monthly submissions from April onwards account for these changes.

Employer contributions

You should have received a Certificate of Pension Contributions Form (LGPS-31) by email.

This shows your certified contribution rate for the scheme year ending 31 March 2025. This will detail your primary rate(s) and a secondary rate (if this applies). This will confirm the rate(s) you must pay from April 2024.

If you have not received this communication then please email [email protected].

New Pension Board member required

Tim Oliver (an Employer Representative), is standing down from the Pension Board in May 2024. We are seeking a replacement. We would love to hear from you by 30 April if you would like to put someone from your organisation forward.

This presents an opportunity for your organisation to be at the heart of the governance of the Pension Fund. You will help drive the best possible outcomes for your employees, the wider Fund membership and other employers.

i-Connect

We continue to onboard the last remaining employers onto i-Connect, a live cloud service for the flow of employee information from your payroll system to the Funds pension administration system.

As we are approach year end (31.03.2024), please submit your March i-Connect returns in a timely manner and ensure that you have reviewed your cumulative values so that the data we use to produce annual benefit statements is accurate for the 2023/24 Scheme year.

Retrospective changes and i-Connect

If you already use i-Connect you will be aware that your monthly submission only includes active members. If you make retrospective changes, such as belated pay awards or restructures to your employees’ payroll and pension records, you may need to give us this information separately from your i-Connect file if the changes are in connection with historic posts. In addition, you will need to check that the information provided for the ongoing post(s) on your file is correct. This is because retrospection in payroll systems can cause the ongoing posts figures to be under or over stated, and this will result in members pension benefits being incorrect.

If you have any queries about i-Connect please contact the team by email at:

Active member newsletter

We have recently produced our latest active member newsletter, full of interesting articles to help your employees keep up to date with their Local Government Pension Scheme. The newsletter is on the website in line with our online communication policy (we do not print copies of non-statutory documents).

We have emailed all those active members that we have an email address for. Those without an email address on our systems will not be aware of the newsletter. So, we are after your help!

It would be great if employers could post the latest online newsletter via your intranet sites or attach a text-only version to noticeboards. Many thanks.

Online active member newsletter

Text only PDF member newsletter

Please also note that we have now moved pensioner payslips and P60s online to 'My Pension' - our member self-service website. Pensioners retain the right to opt-out and receive their documents in the post.

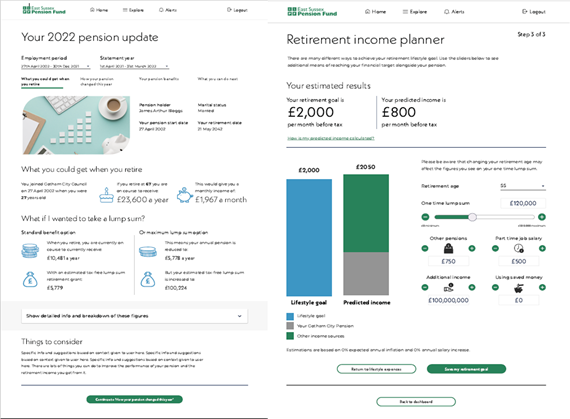

'My Pension' - member self-service improvements

‘My Pension’ provides member access to their Local Government Pension Scheme account(s) online.

We have been working with our software provider on improvements. As a result we will provide access to a new, modernised website later this year.

The new and improved site will make it far easier for members to keep up to date with their pension.

What’s new in ‘My Pension’?

- Simpler login - No need to remember usernames, security questions. Just log in with an email address and password.

- Improved security – there will be a one-off process to set up two-stage authentication. This will improve the website security as well as simplifying ongoing access.

- Updated look and design – making the site easier to find information. With more graphics to aid understanding, updated branding, and colour schemes.

- The website is fully accessible.

- New retirement planner – this will allow members to set retirement goals and identify whether they are on track to reach them.

- Annual Benefit statements – broken down into simpler chunks to aid understanding of what pension benefits have accrued.

‘My Pension’ will retain many of the existing features. Including the ability to update personal details, nominations and more.

Moving online saves money on stationery and postage and also helps reduce our carbon footprint.

Please keep an eye out for future communications regarding this exciting upgrade.

Employer Training

The engagement team continue to provide support for employers. If you have a specific training requirement and need our help, please email us at:

Please note that the LGA also offer employer training courses.

Click on the links below for more details.

• LGA bite-sized training - Employer bite size training (lgpsregs.org)

• LGA Employer role training course - Local Government Association

Hymans Robertson are running a series of training events that would be useful for employers in the LGPS.

- Tuesday 16 April – Final Pay and Assumed Pensionable Pay – theory session.

- Tuesday 23 April – Final Pay – examples session.

- Tuesday 30 April – Assumed Pensionable Pay – examples session.

All sessions will run from 10.00 am to 11.30 am. Each session will allow plenty of time for Q&A, and all participants will receive a certificate of attendance.

If you are interested in registering, the total cost of all three sessions is £1,650 + VAT (for up to 20 people per session). We will be registering all interested employers on their behalf so the cost can be divided up fairly.

The more that sign up the more cost effective it will be – but we won’t know the final cost until we know the total number of employers who have registered.

Should you want to put someone forward please contact our Pensions Training Co-Ordinator at [email protected] before 5 April 2024.

Please note that if more than 20 people are put forward we will be able to register a higher number but will need to negotiate a new price, depending on the numbers involved.

Further support for employers

The Fund offer a range of support material for employers. Here’s a reminder…

Employer Toolkit

We appreciate that sometimes it can seem daunting being an employer in the LGPS. What with:

• Complying with regulation.

• Meeting deadlines.

• Understanding processes.

• Supporting employees.

• Data submission and more.

That is why East Sussex Pension Fund provide an Employer Toolkit.

The toolkit is split into six sections covering the following topics:

|

Absences |

Absence due to sickness or injury Authorised unpaid leave Child related leave APCs during absence |

|

Accounting |

IAS19 & FRS102 reporting Triennial valuation |

|

Administration processes |

Death in service Forms Leavers New starters Opting out Redundancy or efficiency

|

|

Contributions |

50/50 Section Additional pension contributions Additional voluntary contributions Assumed pensionable pay Pensionable pay |

|

Employer responsibilities |

Annual Benefit Statements Auto enrolment Discretions Employer responsibilities in summary i-Connect |

|

Retirement |

Early retirement Normal retirement Late retirement Ill Health retirement Flexible retirement |

HR guide

This guide sets out the requirements for Human Resource (HR) departments of employers who provide the LGPS.

Payroll guide

This guide sets out the requirements for payrolls in respect of the LGPS.

Ill health retirement guide

This guide is to help employers understand what constitutes ill health retirement within the LGPS regulations and details their role in supporting members through the process.

Access Ill Health retirement guide here

Forms

We also have standard and editable forms available for both employers and members.

Employer responsibilities

As an employer you have certain responsibilities under the Local Government Pension Scheme (LGPS). It is important that you familiarise yourself with what is expected. The link below takes you to a document that provides a summary of those responsibilities.

We've also provided a link to the Administration Strategy Statement which sets out your responsibilities as an employer, and ours as the administering authority. It considers policies and performance standards which go towards providing high quality administration services. It also gives details of administration charges for employers who fall short of the standards specified.

East Sussex Pension Fund’s Ill Health Insurance Policy

When one of your members can no longer work and retires due to ill health (after 2 years service), there is an increase in the pension liability for you as the employer (“the strain cost”). These costs can easily run into £100k or more.

This results from:

- Early payment of the pension; and

- An increase in the benefits payable to the member either based on assumed pensionable pay and full prospective service to normal retirement age for a Tier 1 early retirement or 25% for a Tier 2 early retirement.

Ill health insurance was developed at the request of LGPS funds to help employers remove the risk of the often-unaffordable cost of unexpected ill health early retirements. East Sussex Pension Fund offers an ill health insurance policy provided by Legal and General. This is currently in place on an auto-enrolment basis* for all small to medium employers (those with two hundred active members or less) and for some larger employers who have opted into the policy.

*The only exception is for employers who had pre-existing policies with Legal and General (please refer to the terms of your prior policy as coverage will commence from the start date of this agreement).

The Policy is up for renewal on 1 April 2024 so we would like to hear from any employers who aren’t currently covered who would be interested in doing so. If you need any further information, please contact [email protected].

Download Ill Health Retirement Guide – page 13 for Ill Health Insurance Policy information

Download Ill Health Liability Insurance – further information for employers

Annual Report and Accounts

We have recently published our 2022/23 Annual Report and Accounts. Here are some key highlights…

- The Fund had £4,579m of assets on 31 March 2023 to meet the accrued benefits. The funding position was 123% (as at 31 March 2022) comparing assets to liabilities, putting the Fund in a very strong position.

- The investment return for the year to 31 March 2023 was -2.5%. This was an under-performance of the benchmark by 1.4%. This followed an incredibly difficult and volatile investment period.

- Winner of the 2023 best LGPS Governance at the Local Authority Pension Fund awards.

- The membership of the Fund at 31 March 2023 was 84,028 people (24,691 active, 24,124 pensioners and 35,213 deferred) and 140 scheme employers.

- The Fund has continued its journey of responsible investment and consideration of climate risk.

|

Pension Fund Account Summary |

2021/22 £M |

2022/23 £M |

|

Opening Net Assets |

4,244.0 |

4,687.7 |

|

Contributions/other income (Payments from employers, employees and transfers from other pension funds) |

+142.4 |

+157.0 |

|

Benefits and other payments (Pension payments, leaver payments and lump sums) |

- 145.3 |

-146.7 |

|

Management Expenses |

- 26.7 |

- 30.8 |

|

Investment returns (Investments income and change in market value) |

+ 473.2 |

- 88.7 |

| New increase during the year

|

+ 443.6 |

- 109.2 |

|

Closing Net Assets |

4,687.7 |

4,578.5 |

Full report and accounts:

Annual Report and Accounts 2022 23 - East Sussex Pension Fund

McCloud Remedy

The Government have made a change to Local Government Pension Scheme legislation as a result of the McCloud judgment.

The Government reformed public service pension schemes in 2014 and 2015. They did this by moving from final salary schemes to career average schemes. Members who were born before 1 April 1957 had their pensions protected from the changes.

In essence this meant that when they retired, their pension fund compared:

• the career average pension they built up before age 65, with

• the pension they would have built up in the final salary scheme.

If the final salary pension was higher, the difference was added to their pension. This protection is called the underpin.

Members do not need to do anything. If they are an active or deferred member, we will give them an estimate of how the underpin (if applicable) may affect their pension in their 2025 Annual Benefit Statement which must be issued by 31.08.2025.

If we are already paying them a pension, we will review it. We have thousands of records to review, and this process will take some time. We have told members not to contact us as there is nothing more we can tell them now. We have written to those who may be affected. The link below will provide further information.

The McCloud remedy - for active members | East Sussex Pension Fund

Next day transfer process

People move roles with an employer on a regular basis. This could be because of restructure, sideways move, promotion, or other reasons. When this happens, the employer often provides East Sussex Pension Fund with a new payroll reference or post number and we treat it as a next day transfer.

Our previous process treated each employee post as a separate pension record. This meant pension scheme members ended up with one deferred (or leaver) record in respect of the old role and one active record (in respect of the new role). The Pensions team would then offer the member the chance to amalgamate their records together by writing to them along with their deferred benefit notification. The old process caused confusion as from their perspective they had never left employment.

We have changed this process. Now, when we are notified of a member leaving with a leaver reason of “job transfer/ transfer within department”, we wait for the new record to be created. We then make a check against both records that the full-time equivalent pay is either the same or higher on the on-going record, process the next day transfer and put the records together*. A letter of confirmation of this action taking place is then sent to the member. The member does retain the right to have separate records.

*This may not be advantageous to the member if the new role isn’t paid as much as the old one (so it’s in their financial interests to leave the ‘deferred’ record as it is).

From a member perspective this is far less confusing as they will only have one record throughout and won’t receive leaver notifications. If you have any questions, please email [email protected].