Important information about your Additional Voluntary Contribution (AVC) investments

East Sussex County Council Pension Fund (the Fund)

East Sussex County Council Pension Fund (the Fund)

Following a recent review of the investment options offered through the Fund’s AVC arrangement with Prudential, we’re contacting you to let you know about some future changes to the AVC investment range.

As a member of the Fund, you will currently be invested in one of the following Prudential investment options:

The Committee have recently reviewed the investment options made available to members and have decided to change the default investment option to new members of the Fund, as well as make some changes to the self-select fund options made available to all members. A revised AVC fund guide will be available on the East Sussex Pension Fund website from 31 October 2025 which will include descriptions of the Lifestyle options available.

For new members of the Fund:

- The Prudential Dynamic Growth Lifestyle strategy (targeting 100% Cash at retirement) will be the default investment option for new members joining the AVC arrangement going forward. The Prudential With-Profits Fund will be available as a self-select option should members wish to invest in the fund. An overview of the strategy is provided in Appendix A.

For existing members of the Fund:

- There will be no changes with how your savings are invested. Your accrued benefits and future contributions will continue to be invested in the Prudential With-Profits Fund unless you make an alternative investment choice.

The Committee, together with its advisers, believe that Prudential Dynamic Growth Lifestyle strategy (targeting 100% Cash) is better suited to the needs of new members, in terms of growing pots and how these pots might be taken. Life-styling is an investment strategy which provides automatic switching of a member’s pension savings from higher-risk into lower-risk funds as you move closer to your planned retirement age. The ‘targeting cash’ lifestyle strategy is for those intending to take their pot value as a cash lump sum.

This does not consider any specific characteristics, and other options may be more suitable for an individual. The With-Profits fund does feature guarantees that should be considered in relation to any existing pots already built up.

The Committee has decided to introduce the Prudential HSBC Islamic Global Equity Index fund into the self-select range, providing members with the opportunity to invest in line with their beliefs.

At the same time, the Prudential Fixed Interest Fund and the Prudential Index-Linked Fund will be formally removed for the current self-select range. These funds were previously closed by Prudential to new investment and the Committee are satisfied suitable alternatives already exist within the self-select range.

These changes will not directly impact your current investments, and you are not required to take any action.

If you are already invested in the Prudential With-Profits Fund, you can continue to remain invested in this fund. In addition, as you do not hold any benefits in the Prudential Fixed Interest Fund and the Prudential Index-Linked Fund the removal of these funds will not have an impact.

You may however wish to take the opportunity to review your investment options. The future investment options for East Sussex Pension Fund AVC members are shown below.

|

HSBC Islamic Global Equity Index Prudential Dynamic Growth I Prudential Dynamic Growth II Prudential Dynamic Growth IV Prudential Dynamic Growth V Prudential Cash Prudential Discretionary Prudential UK Equity Index Prudential Overseas Equity Index Prudential Positive Impact Fund Prudential Long-Term Gilt Passive Prudential With-Profits |

|

|

Lifestyle Options

Prudential Dynamic Growth Lifestyle Targeting Cash (Default) Prudential Dynamic Growth Lifestyle Targeting Retirement Options |

To update your investments, you can:

Further fund information can be found on the Prudential’s Workplace Pension factsheets area of their website.

It is always a good idea to review your investment choices to ensure they continue to be suitable for your own circumstances and retirement savings objectives. We recommend that you consider the risk warnings information available from Prudential before making investment decisions. You should also remember that the value of your pension savings can go down as well as up and it is not guaranteed, so you could get back less than you invest. It is therefore important that you understand that past performance is not a guide to future returns.

Please note, neither the Committee, the East Sussex County Council nor Prudential are able to provide you with personal financial advice in connection with the suitability of your investment options. If you feel you need advice you should speak to a regulated financial adviser authorised by the Financial Conduct Authority.

If you need help finding a regulated financial adviser, you can visit https://www.moneyhelper.org.uk/en/getting-help-and-advice/financial-advisers/choosing-a-financial-adviser

The adviser will inform you of any charges that apply in return for their advice.

Yours sincerely

Paul Punter

Head of Pensions Administration

East Sussex Pension Fund

---------------------------------------------------------------------------------

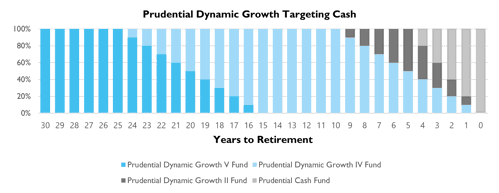

The Lifestyle Option, the Prudential Dynamic Growth (PDG) Targeting Cash, means throughout the period before your Scheme Normal Retirement Age (SRA) your funds are automatically, gradually moved from one investment fund to another. The graph below shows the funds included in the lifestyle option, where you’re initially invested and how the proportions invested change automatically, to achieve the pre-set proportions, each year to retirement.

You can find information on all funds available to you in the AVC fund guide, available on the East Sussex Pension Fund website from 31 October 2025, including relevant fund charges and risks associated with choosing different investments. As a lifestyle option moves your money between funds, the actual fund charges you pay will be based on a proportioned split between the funds you’re invested in and the fund charges and costs applicable at that time

Further fund information on the individual funds that make up the Prudential Dynamic Growth Targeting Cash lifestyle option can be found on the Prudential’s Workplace Pension factsheets area of their website. If you are unsure about the funds available, we recommend that you seek financial advice.